For W2 Earners Making $400K+ Who Want to Keep More of What They Earn

Here’s How High-Income Professionals Are Using

Trump's Big Beautiful Bill

to Slash Taxes — By Owning a Tiny Home at our All-Inclusive Adventure Resort

We Are Currently In Phase 3 of investing

Starting at 200k: New build Units

For W2 earners with $400K+ income & $200K+ capital. We’ll walk you through how the strategy works, step-by-step.

FEATURED IN

Here’s How It Works in 3 Simple Steps

You own the cabin outright. No shares. No REITs. Just direct ownership of a premium, income-producing asset.

Under our current structure, this includes a contractual minimum monthly payment of $1,700–$2,400 — depending on the specific cabin and contract terms.

This means you earn predictable monthly income — with none of the operational headaches.

*Minimum income is subject to the terms of the executed agreement. Actual figures depend on final contract selection and investor accreditation verification.

*Please consult your CPA to determine how your participation and income profile affect deductibility.

Why This Works When Traditional Strategies Don’t

Most W2 earners are boxed into one answer: “Max out your 401K.”

But this strategy flips the script — by combining a cash-flowing asset with IRS-approved equipment classification.

W2 professionals typically can’t take real estate losses unless they become real estate professionals or manage an STR themselves — which kills the “passive” dream. Our approach is different.

By leveraging a modular cabin that behaves like business equipment — and placing it in a real, revenue-generating resort — you can unlock the kind of first-year write-offs that normally require a full-blown business.

For W2 earners with $400K+ income & $200K+ capital. We’ll walk you through how the strategy works, step-by-step.

Congress Passes Trump's "Big Beautiful Bill" Bringing Back 100% Bonus Depreciation

URGENT for Any W2 Earner Who Wants To Take Advantage Of These Cuts Within The 2025 Tax Year

Thanks to the newly passed legislation, often called the “Big Beautiful Bill,” investors can once again immediately write off up to 100% of qualified equipment purchases -- in the same tax year the purchase is made.

We've worked with a team of lawyers and CPAs to structure this entire purchase as ACTIVE INCOME (see below). You may qualify for these same tax benefits our other investors are taking advantage of in 2025.

For example, if you invest $200,000 in qualified assets, you can potentially deduct the full $200,000 this tax year - dramatically lowering your tax bill, or even creating a paper loss that you can carry forward into future tax years (depending on your individual tax situation).

Why High-Income W2s Love This Strategy

This isn't just about taxes. It's about smarter wealth-building — without changing careers or becoming a landlord.

Major Tax Savings

Use the Big Beautiful Bill to potentially offset active income — which may include income generated through this asset, if structured properly.

Real Ownership, Real Cash Flow

You own a luxury cabin placed at a booming resort — not shares, not syndicates. Just real income and direct ownership.

Low Management

We handle everything. The guests, the bookings, the operations. You collect income and just oversee our work.

How Are You Getting Around the “Active Trade or Business” Rule?

We’re not getting around it — we’ve structured for it.

If you're a high-income W2 earner looking to use this investment to offset active income via the 100% Bonus Depreciation from the Big Beautiful Bill, here’s how we make that legally and operationally viable.

👔

Manager of Managers Role

We define your position in the management contract as an active participant — with clear oversight responsibilities.

💵

Minimum Monthly Payment

Even with active structuring, you'll receive a minimum income, or upside from shared revenue. Which ever one is greater.

🧾

The Big Beautiful Bill

You may be able to file as an active business — unlocking 100% bonus depreciation and business deductions.

Instead of a passive lease, we create a custom revenue-sharing management agreement — built specifically to qualify as an active trade or business. Your role is structured as a manager of managers, which allows the income and expenses to be reported on Schedule C. That opens the door to:

100% bonus depreciation from the Big Beautiful Bill

Active income deductions

Write-offs typically reserved for business owners

All without quitting your W2 job — and with hands-off operations fully managed by our team.

*Your eligibility to deduct income or expense this investment on Schedule C depends on your tax profile. We provide custom contracts and structure — your CPA determines treatment.

For W2 earners with $400K+ income & $200k+ capital. We’ll walk you through how the strategy works, step-by-step.

What You Actually Own

You’re not buying shares in a fund or investing in a REIT. You own a beatiful, premium, new build tiny homes — located directly on our fully operational, high-demand All-Inclusive adventure resort.

This is direct asset ownership — a real, cash-flowing Tiny Home that generates monthly income and qualifies for tax advantages under the Big Beautiful Bill with bonus depreciation up to 100%.

We take care of the rest — including the guests, maintenance, insurance, and property taxes. It’s as hands-off as it gets — but with all the upside of asset ownership.

📍Where Is This Resort Located?

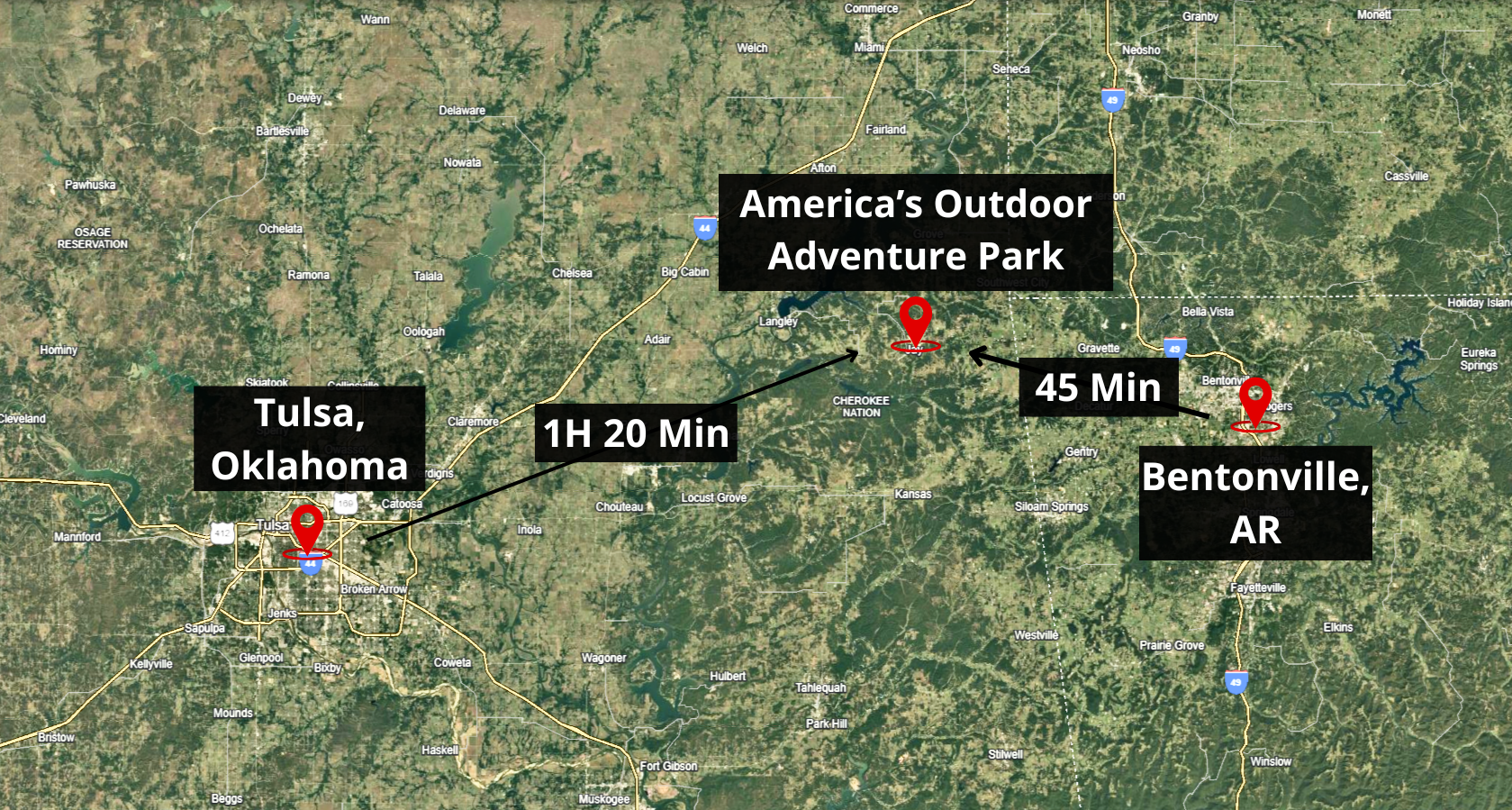

AOAP is a 383-acre, all-inclusive Adventure resort located in Jay, Oklahoma between Bentonville, AR and Tulsa, OK — just 20 minutes from Grand Lake, one of the top outdoor destinations in the Central South.

It’s already built. Already cash flowing. Already attracting thousands of guests from across 5 states — and now, you can own a piece of it.

For W2 earners with $400K+ income & $200k+ capital. We’ll walk you through how the strategy works, step-by-step.

Executive Summary

we are literally the disneyland for Moto Enthusiasts

America's Outdoor Adventure Park isn't just an off-road park; it's a one-of-a-kind, all-inclusive resort designed for thrill-seekers and families alike.

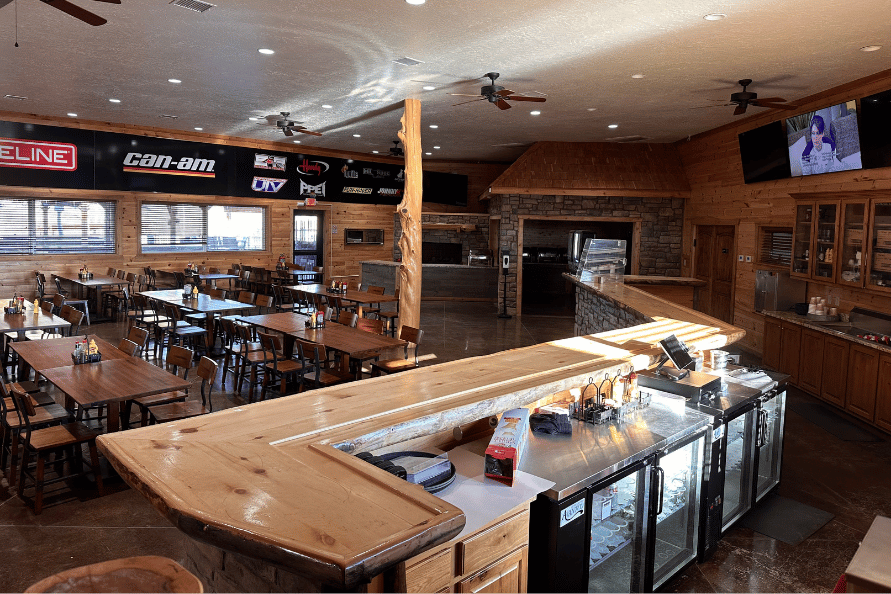

With 380 RV spots, 31 cabins (totaling 55 units), four bars, a 5 star restaurant, a sprawling pool complex, racetracks, and extensive trails, we offer an unparalleled experience.

Our appeal stretches far beyond a regional draw. Customers from coast to coast visit for our major events or indulge in our 3 or 5 day "Ultimate Experience" all-inclusive packages.

Everyone leaves loving the adrenaline-filled, family-friendly vacation we deliver.

just take a look at our amenities

TRAIL-ACCESSIBLE CREEKS & SPRINGS

CUSTOM RC TRACK

ATV/UTV TRAILS

6 STALLS ATV/UTV WASH BAY

DRAG STRIP

ALL-LEVEL RACE TRACKS

GENERAL STORE/MERCANTILE

COFFEE SHOP

PLAYGROUND

Resort Pool

PAVILION VENUE & GARDENS

LODGE RESTAURANT & BAR

CIGAR/VIP LOUNGE (Coming Soon)

For W2 earners with $400K+ income & $200K+ capital. We’ll walk you through how the strategy works, step-by-step.

How We Stack Up

A Qualitative Comparison

OIL & GAS

Return: 12-18%

Risk: -80%

Appreciation: Minimal

Management: Low

Yearly cashflow: 12-13%

Tax benefits: Active Income Deductions

Real Estate

Return: 10-15%

Risk: -10%

Appreciation: 3-4% Yearly

Management: High

Yearly cashflow: 5-7%

Tax benefits: Passive Income Deductions

AOA's Investment

Target Return: 14%*

Target Risk: -10%*

Appreciation: 3-4% Yearly*

Management: Low

Yearly cashflow: 10%*

Tax benefits: Active Income Deductions**

*Return and risk metrics are based on what management believes can be achievable results may vary. Please consult your financial advisor.

**Tax treatment may vary based on your personal situation. Please consult with your CPA

For W2 earners with $400K+ income & $200K+ capital. We’ll walk you through how the strategy works, step-by-step.

The Team Behind

America’s Outdoor Adventure Park

The Team Behind America’s Outdoor Adventure Park

Michael Hyams,

Co-Founder

Michael has been a fixture in the resort business for decades. He has purchased, developed, operated and sold 12 resorts, 6 casinos, and held countless events with national attendance and recognition. This ain’t his first rodeo!

Lorenzo Ayres,

Co-Founder

Lorenzo has experience raising millions of dollars of investments in the unique stay space, as well as founding and consulting multiple companies that have scaled to millions of dollars through strong direct-response style digital advertising.

Jonathan Strong

CMO

$200M+ In Digital Ad Spend

Marcus Wiesner

Director Of Marketing

4,500% Lifetime ROI

Felicia Robinett

Operations Director

Events Management & General Operations

Jessica Konemann

Finance Director

FP&A

Bryan Dutson

Investor Relations Advocate

Frequently Asked Questions

How Can You Write Off 100% Off Of Your Active Income?

We have set up our cabins (what you are buying) to be able to be categorized as equipment via the IRS guidelines. This allows you to DEPRECIATE up to 100% of your purchase year one thanks to the BIG BEAUTIFUL BILL. This BONUS DEPRECIATION will generate a business income loss which can be used to offset your W2 income or other business income.

What Makes This Investment Less Risky?

You have the collateral just like you would be purchasing non syndicated real estate and your payback period is very quick. Most equity or bond investments you are not directly tied to collateral that you can repo! In this situation you can. You OWN the WHOLE cabin. Not a share in a business that owns the cabin. You have direct ownership which lowers the risk of loss.

How Are We Using Your Funds?

We will use your funds the following way:

Working Capital: General expenses such as hiring, salaries, maintenance expenses

Expansion of Park Amenities: Expanding our racetracks, RC boats track and strategic land acquisition for additional trail riding

Strategic Growth Investments: We have plans to expand our package offerings. We currently have our 3-5-7 day ultimate experiences. Your funds will be used to purchase more UTV's and additional equipment needed to expand those offerings

What’s The Minimum Investment And Who Qualifies?

Minimum investment is $200,000, and you must be an accredited investor per SEC guidelines. If that’s you, you’re invited to book a free opportunity call now.

What's an Accredited Investor?

Income: Having an individual income exceeding $200,000 in each of the two most recent years, or a joint income with a spouse exceeding $300,000 for those years, and a reasonable expectation of reaching the same income level in the current year.

Net Worth: Having a net worth exceeding $1 million, either individually or jointly with a spouse, excluding the value of their primary residence.

Professional Certifications and Designations: Holding in good standing certain professional certifications, designations, or credentials that demonstrate financial sophistication (e.g., Series 7, Series 65, Series 82 licenses).

Is My Money Locked Up Long-Term?

No. You’ll have 100% liquidity starting after year 2, with flexible exit options depending on your investment agreement.

What Kind Of Returns Should I Expect?

You’ll receive a target 10% annual cash flow, with a target IRR of 14%, depending on the terms you select.

How fast can I start earning?

Once you complete your investment, your cabin is leased back to us immediately. Cash flow begins with your first payment, and you’ll receive all agreements, proformas, and tax documentation up front during the due diligence process.

Disclosures:

America's Outdoor Adventure Park, LLC doing business as America's Outdoor Adventure Park (the “Company”) conducts offerings pursuant to Rule 506(c) of Regulation D under the Securities Act of 1933, as amended (the “Securities Act”). Offerings under Regulation D are exempt from the registration requirements of the Securities Act. Importantly, only “accredited investors”, as such term is defined in Rule 501 of Regulation D., may invest in Rule 506(c) offerings. For the avoidance of doubt, individuals (i.e., natural persons) may qualify as “accredited investors” based on wealth and income thresholds, as well as other measures of financial sophistication. For example, individuals may qualify as “accredited investors” if they have (i) net worth over $1 million, excluding primary residence (individually or with spouse/partner), or (ii) income over $200,000 (individually) or $300,000 (with spouse/partner) in each of the prior two years, and reasonably expect the same for the current year. In addition, certain entities (i.e., not natural persons) may qualify as “accredited investors.” The Company has posted a private placement memorandum (together with any related amendments and supplements thereto, the “private placement memorandum”) on its website, which can be accessed via the following link: https://aoapark.com/invest-in-aoap Before you invest, you should read the private placement memorandum in full for more information about the Company and offering, including the risks associated with the business and securities and the definition of “accredited investor” included therein. While the Company may use general solicitation and general advertising with respect to its Rule 506(c) offerings, which may be conducted through a number of different means, including, among others, the internet, social media, seminars/webinars, and print, the Company will take reasonable steps to verify that the purchasers investing in such offerings are “accredited investors.” To that end, investors wishing to purchase securities in such offerings will be required to provide certain supporting materials and other information to the Company for the purpose of verifying “accredited investor” status. Any investment decision will be made only on the basis of the information included in, and for the securities described in, the private placement memorandum. This presentation and the private placement memorandum relate only to securities being sold by the Company pursuant to Rule 506(c) of Regulation D. Investing is subject to risks and should be made only by persons or entities able to bear the risk of and to withstand the total loss of their investment. Investors should always conduct their own due diligence and consult with a reputable financial advisor, attorney, accountant, and any other professional that can help them to understand and assess the risks associated with any investment opportunity. Major risks, including those related to the potential loss of some or all principal, are disclosed in the private placement memorandum for the Company’s offerings under Regulation D. Private placements are speculative and illiquid. Past performance is not indicative of future results. The materials set forth on the Company’s website and presentations were prepared by the Company and the analyses contained therein are based, in part, on certain assumptions made by and information obtained from the Company and/or from other sources. The information may not be comprehensive and has not been subject to any independent audit or review. The Company’s internal estimates have not been verified by an external expert, and we cannot guarantee that a third party using different methods would obtain or generate the same results. The Company does not make any representation or warranty, express or implied, in relation to the fairness, reasonableness, adequacy, accuracy or completeness of the information, statements or opinions, whichever their source, contained in such materials or any oral information provided in connection with its presentations or discussions with investors, or any data it generates, and accepts no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information. The information and opinions contained in the materials are provided as of the date specified therein, are subject to change without notice and do not purport to contain all information that may be required to evaluate the Company. The Company and its affiliates, officers, employees and agents expressly disclaim any and all liability which may be based on the materials and any errors therein or omissions therefrom. Neither the Company nor any of its affiliates, officers, employees or agents makes any representation or warranty, express or implied, that any transaction has been or may be effected on the terms or in the manner stated in the materials, or as to the achievement or reasonableness of estimates, prospects or returns, if any. You are cautioned not to give undue weight to such estimates. Numerical figures in the materials have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.The materials include forward looking statements that reflect the Company’s current views with respect to, among other things, the Company’s growth, operations and financial performance. Forward looking statements include all statements that are not historical facts. These forward looking statements relate to matters such as the Company’s industry, business strategy, goals, and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity, and capital resources and other financial and operating information. These forward-looking statements are generally identifiable by forward looking terminology such as “expect,” “believe,” “anticipate,” “outlook,” “could,” “target,” “project,” “intend,” “plan,” “seek,” “estimate,” “should,” “will,” “approximately,” “predict,” “potential,” “may,” and “assume,” as well as variations of such words and similar expressions referring to the future. Oral information provided in connection with the Company’s presentations or discussions with investors may similarly include forward looking statements. The forward looking statements contained in the materials, including but not limited to any outlook, targets or projections, are based on management’s current expectations and are not guarantees of future performance. The forward looking statements are subject to various risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. For example, projections included in the materials assume the Company has continued access to adequate sources of capital to fund operations. The Company’s expectations, beliefs, and projections are expressed in good faith, and the Company’s management believes there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs, and projections will result or be achieved. Actual results may differ materially from these expectations due to changes in global, regional, or local economic, business, competitive, market, regulatory, and other factors, many of which are beyond our control. Management believes that these factors include but are not limited to the risk factors the Company has identified in its offering circular under “Risk Factors.” Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. The Company may not actually achieve the plans, intentions or expectations disclosed in such forward looking statements and you should not place undue reliance on the Company’s forward looking statements. The Company undertakes no obligation to publicly update or revise any forward looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable securities laws.

Generally, the Company, in its filings, discloses key performance indicators such as occupancy rates, average daily rates (ADR), and revenue per available room (RevPAR), which management believes provide a reasonable basis for evaluating the Company's performance under existing economic and operating conditions. The Company may also disclose certain internal projections for future performance that meet management's definitions for such metrics. The Company's estimated key performance indicators and projections are prepared by the Company's internal finance and operations teams. These internal estimates and projections are not audited by an independent accounting firm. Additional information on the Company’s performance and outlook is contained in the Company’s filings. In these materials, the Company may use terms such as “potential revenue,” “future growth opportunities,” or “market potential,” which accounting guidelines may not specifically define for inclusion in all filings. “Potential revenue,” “future growth opportunities,” or “market potential” refer to the Company’s internal estimates of potential financial performance that may be realized through future operational strategies, market expansion, or capital investments. Such terms do not constitute standardized financial measures under accounting principles generally accepted in the United States (“GAAP”) and may not align with definitions used by other companies. Actual financial results ultimately achieved will differ substantially. Factors affecting ultimate financial results include the scope and success of new initiatives, which will be directly affected by the availability of capital, operating costs, availability of personnel and resources, market conditions, competitive factors, lease agreements, regulatory approvals, and other factors. Actual operational results, including occupancy rates and pricing, may also differ significantly due to economic and market fluctuations. Estimates may change significantly as market conditions evolve and the Company gains more operational data. In addition, our performance forecasts and expectations for future periods are dependent upon many assumptions, including estimates of occupancy, pricing, demand trends, and the undertaking and outcome of future strategic initiatives, which may be affected by significant economic downturns or increases in operating costs. Estimated key performance indicators and internal projections do not represent or measure the fair value of the Company's assets or the fair market value at which the Company or its individual properties could be sold. In the event of any such sale, proceeds to the Company may be significantly less than the projected financial performance. Certain materials may contain “non-GAAP financial measures” that are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with accounting principles generally accepted in the United States (“GAAP”).Specifically, the Company presents “EBITDA” as a supplemental measure of financial performance that is not required by, or presented in accordance with, GAAP. The Company believes this measure can assist investors in comparing the Company’s operating performance across reporting periods on a consistent basis by excluding items that it does not believe are indicative of its core operating performance. Management believes these non GAAP measures are useful in highlighting trends in the Company’s operating performance, while other measures can differ significantly depending on long term strategic decisions regarding capital structure, capital investments, etc. Management uses these non-GAAP measures to supplement GAAP measures of performance in the evaluation of the effectiveness of the Company’s business strategies and to make budgeting decisions. Management supplements GAAP results with non-GAAP financial measures to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone provide. However, this measure should not be considered as an alternative to net income (loss) as a measure of financial performance or cash provided by operating activities as a measure of liquidity, or any other performance measure derived in accordance with GAAP. The presentation of this measure has limitations as an analytical tool and should not be considered in isolation, or as a substitute for the Company’s results as reported under GAAP. The America's Outdoor Adventure Park designed logo, and our other registered or common law trademarks, service marks, or trade names appearing in the materials are the property of the Company. Solely for convenience, trademarks, tradenames, and service marks referred to in the materials appear without the ®, TM, and SM symbols, but those references are not intended to indicate, in any way, that the Company will not assert, to the fullest extent under applicable law, its rights to these trademarks, tradenames, and service marks. The materials may contain additional trademarks, tradenames, and service marks of other companies that are the property of their respective owners. The Company does not intend our use or display of other companies’ trademarks, trade names, or service marks to imply relationships with, or endorsement or sponsorship of the Company by, these other companies.Okay, I can adapt those risk factors to be more relevant to America's Outdoor Adventure Parks' leaseback offering. Here's a revised version focusing on the specific risks associated with that type of business and investment:

Risk Factors:

An investment in this offering is highly speculative and suitable only for persons or entities able to bear the risk of and to withstand the total loss of their investment. Prospective investors should carefully evaluate the risks of this investment and should only invest if they can afford to lose their entire investment. Prospective investors should consider the following risks, as well as the other risk factors set forth in our offering materials, before deciding to purchase a leaseback interest.

Risks Related to the Leaseback and this Offering Include, Among Other Risks:

We may not generate sufficient revenue from park operations to meet leaseback payments. Our ability to make timely leaseback payments depends heavily on the success and profitability of our outdoor adventure parks. Factors such as weather, seasonality, economic downturns affecting discretionary spending, local competition, safety incidents, and changes in consumer preferences for outdoor activities could negatively impact park attendance and revenue, potentially hindering our ability to fulfill our leaseback obligations. The leaseback payments represent a significant financial obligation. Our commitment to make regular leaseback payments could strain our cash flow and limit the funds available for park operations, capital improvements, expansion, or unforeseen expenses. A significant downturn in our business could make it difficult to meet these obligations. The value of the underlying park assets may fluctuate. The value of the land, improvements, and equipment associated with our outdoor adventure parks can be subject to market fluctuations, environmental factors, and the overall condition of the properties. In the event we are unable to meet our obligations, the value realized from the underlying assets might be less than the outstanding leaseback amounts. The leaseback structure may limit our operational flexibility. The terms of the leaseback agreement could impose restrictions on our ability to manage and develop the parks, potentially hindering our ability to adapt to changing market conditions or pursue strategic opportunities. There is no established secondary market for the leaseback interests, and one is not expected. This lack of liquidity may make it difficult for investors to sell or otherwise dispose of their leaseback interests should they need or wish to do so. We are subject to regular leaseback payments which may impact our ability to manage our overall financial obligations. The fixed nature of the leaseback payments, regardless of our operational performance, could create financial strain, especially during periods of lower revenue. Leaseback holders have limited ability to directly influence park operations. As investors in a leaseback structure, holders typically have limited control over the management and operational decisions of the adventure parks, despite their financial stake. We may have the option to repurchase the leaseback interests, potentially at a time that is unfavorable to the holders. The offering documents may grant us the right to repurchase the leaseback interests, and this could occur when market conditions or our financial situation makes it advantageous for us, but potentially less so for the holders.

Risks Related to Our Business and Operations Include, Among Other Risks:

The outdoor adventure park industry is competitive and subject to inherent risks. The business of developing and operating outdoor adventure parks is competitive and involves risks such as accidents, injuries, equipment malfunctions, adverse weather conditions, and changing safety standards, any of which could negatively impact our reputation, increase our liability, and reduce park attendance. Our business is sensitive to economic conditions and discretionary consumer spending. Consumer spending on leisure and recreation is often discretionary and can be significantly impacted by economic downturns, unemployment rates, and changes in consumer confidence. We may have a limited operating history for some or all of our parks, making it difficult to evaluate their long-term potential. Newly developed parks or acquisitions may have limited performance data, making it challenging to accurately predict their future success and profitability. Our projections for park attendance and revenue are based on numerous assumptions that may prove inaccurate. Factors such as local demographics, marketing effectiveness, competitor activities, and unforeseen events can significantly affect actual park performance compared to our initial projections. Our development and expansion plans may require significant capital expenditures and may not be completed on time or within budget. The development of new parks or the expansion of existing ones requires substantial capital investment and is subject to risks such as construction delays, cost overruns, permitting issues, and financing challenges. Our business is subject to various government regulations and permitting requirements. The development and operation of outdoor adventure parks are subject to federal, state, and local regulations related to safety, environmental protection, land use, and zoning. Delays in obtaining permits or changes in regulations could adversely affect our development plans and operating costs. Unfavorable local economic conditions or changes in tourism patterns could negatively impact park attendance and revenue. The success of our parks depends on the attractiveness of their locations and the willingness of people to travel to and visit them. Economic downturns in the regions where our parks are located or shifts in tourism trends could reduce visitor numbers. Our insurance coverage may not be adequate to cover all potential liabilities. While we maintain insurance, there is no guarantee that our coverage will be sufficient to cover all potential claims or losses arising from accidents, injuries, or other incidents at our parks.

Tax Disclaimer:

The information contained on this page is for educational and general informational purposes only and is not intended as tax, legal, or accounting advice. Results may vary based on your personal tax profile, entity structure, level of participation, and other factors. Any potential deductions or tax treatments referenced (including those under IRS Section 179, Section 168(k), and the Big Beautiful Bill) require proper structuring and qualification as part of an active trade or business. You should consult your own certified public accountant (CPA), tax attorney, or licensed financial advisor to evaluate whether this strategy is appropriate for your situation. We do not provide individualized tax advice or file returns on your behalf. All investors are responsible for their own tax reporting and compliance with IRS regulations.